How to pay resident taxes on maternity leave

Taxes – the one thing no one likes but we all have to do. If you’re like me, you have never spent too much attention to your taxes unless for the obligatory year end tax filing.

As an employee of a Japanese company the attention became even less as they are handling all tax payments and even the tax return for you. Unless you have any special income, medical expenses, etc. Then you really should look into it yourself.

The handling of the taxes by your company is put on hold while you are on maternity leave. Therefore, let me share my experience of what happens during that time.

What are resident taxes?

Resident taxes are taxes that you are paying for having a residence in Japan as of the 1st of January of each year. The tax consists of a per capita and per income levy.

How do you usually pay resident taxes?

Usually the resident tax is withheld directly from your salary by your company. Take a look at your pay slip to see how much resident taxes you are paying on a monthly basis.

How do you pay resident taxes during your maternity leave?

Change of Payment Method

As you go on maternity leave you will not receive your salary paid by your company. Therefore, the resident taxes cannot be withheld from your salary. Your company informs your ward about the change of your situation. Your company will also inform you about this change with an official letter.

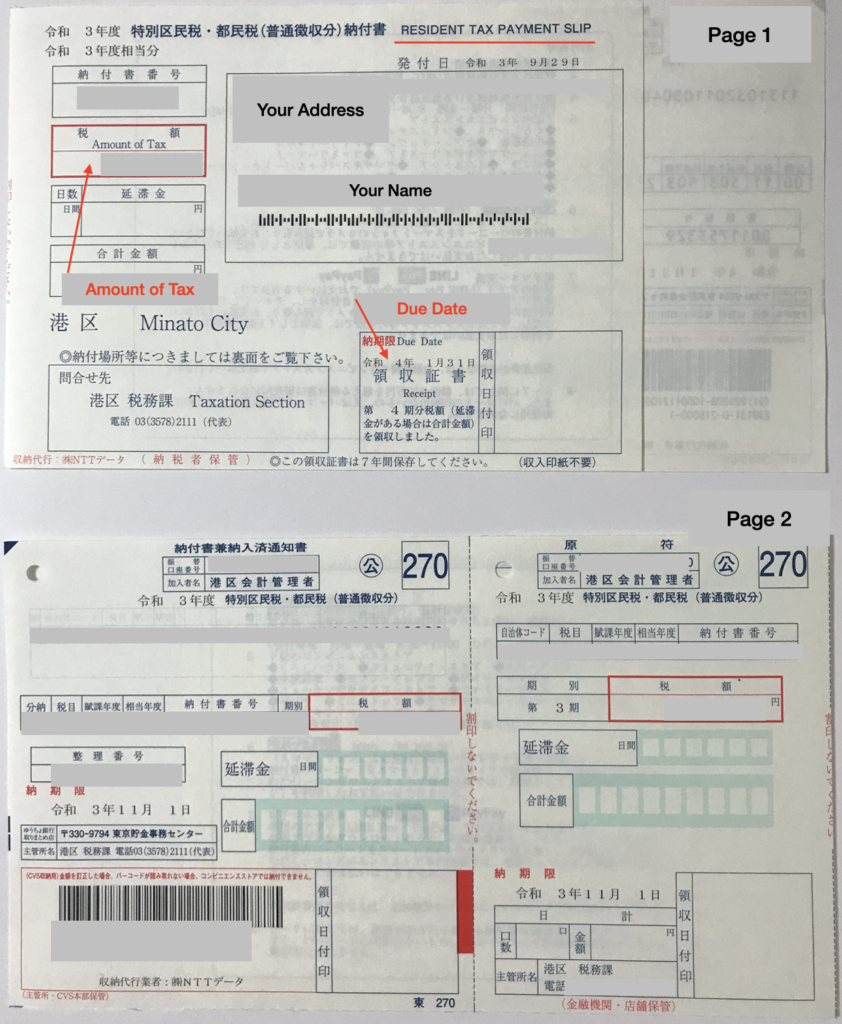

If the resident tax is not withheld from your salary on a monthly basis, a payment on a quarterly basis is common. Therefore, the ward office will send you your resident tax bill to your house. This letter will include an information leaflet, a resident tax overview sheet and resident tax payment slips with the tax amount due and payment deadlines.

Where to pay

You can pay at banks and credit unions or at post offices. The payment at post offices is most likely restricted to a certain area and not everywhere in Japan.

You can also conveniently pay the taxes by presenting the resident tax payment slip at a ‘konbini’ (if the payment slip has a bar code and the amount is up to 300,000JPY) such as 711 or Lawson.

Mark the payment deadlines well and pay on time. Otherwise a penalty payment will become due on top of the tax payment.